Contents

Live music and entertainment venues are complex, shared worksites. Staging crews, lighting technicians, sound engineers, and venue staff often work alongside one another in confined spaces, under tight schedules and constant time pressure. In this environment, even a minor incident can escalate quickly once equipment owned by another contractor is involved.

When damage occurs, questions around liability and payment often arise before an insurer has the opportunity to properly review the situation. That gap between incident and assessment is where stress, confusion, and financial risk tend to build.

Late last year, an Australian staging business found itself in exactly this position.

Key Takeaways:

- Don’t pay a third party’s damage claim out of pocket before your insurer has assessed it

- Submit a complete evidence pack early (photos, invoices, incident summary) so the insurer can assess the claim quickly

- Having your broker coordinate directly with the third party takes the pressure off your business

- For venue-based businesses, review your public liability cover before an incident happens

What Went Wrong During the Event

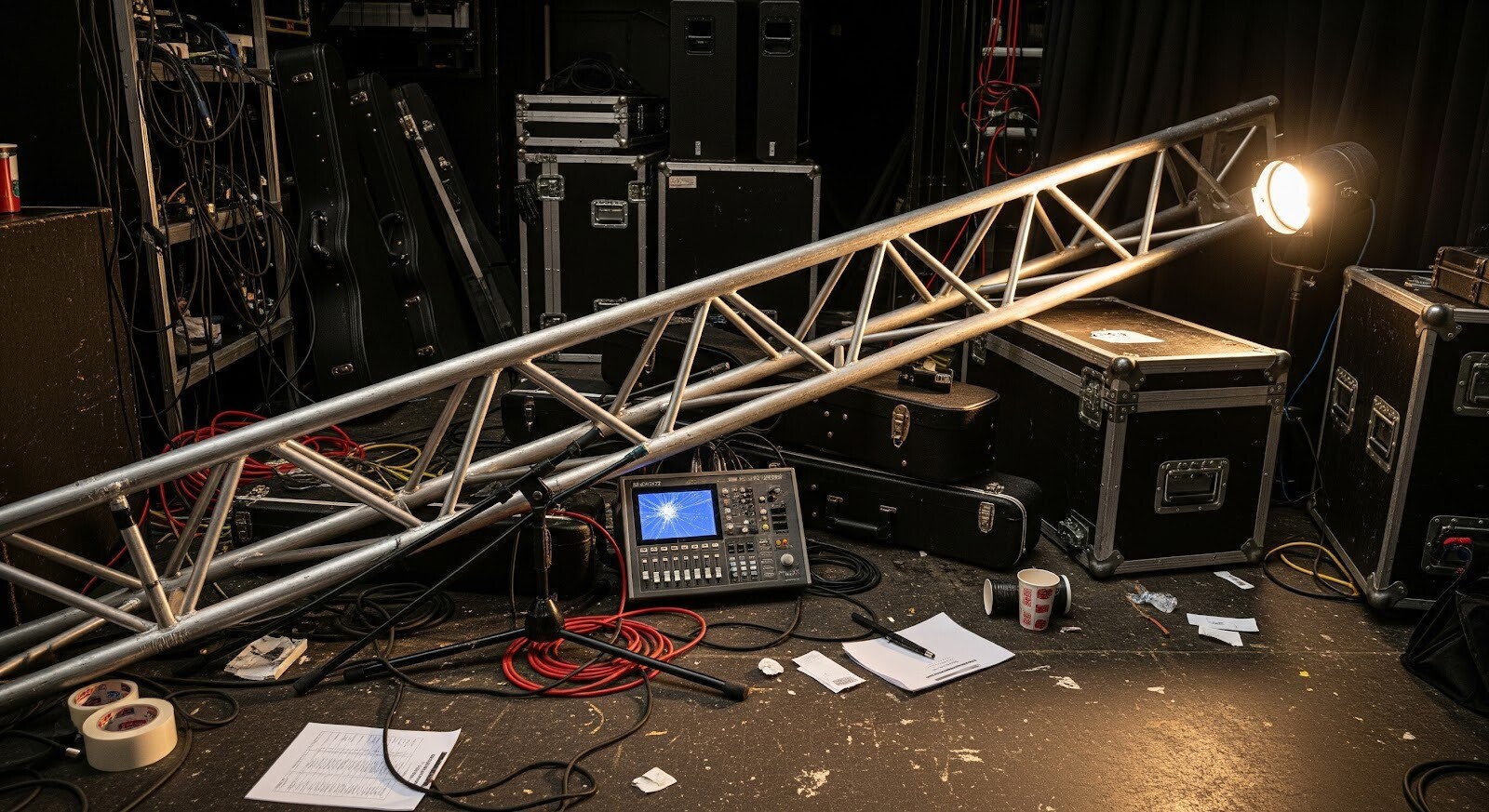

While working at a Sydney venue, one of the client’s staff members accidentally knocked over steel framing. The framing fell onto equipment owned by another contractor, causing damage.

No one was injured, and the incident was limited to property damage. Despite this, the third party issued an immediate demand for compensation, seeking close to $10,000 and pressing for payment before the insurance claim had been reviewed.

For the client, what began as an operational issue quickly became a high-pressure situation.

Why Immediate Payment Demands Increase Pressure for Businesses

The cost itself was only one part of the problem. The client was also facing:

- The risk of legal action if payment was delayed

- Strained professional relationships at the venue

- Disruption to upcoming production schedules

For businesses that rely on repeat venue work, maintaining those relationships is critical. Immediate payment demands often arrive before insurers have confirmed liability or assessed how a policy responds, leaving business owners caught between financial exposure and operational reality.

Do Insurers Need Time to Assess Third-Party Damage Claims?

Yes.

Before responding to a third-party damage claim, insurers typically need time to:

- Confirm who is legally responsible

- Review invoices, photos, and incident details

- Assess how the public liability policy applies

Paying a third party before this process is complete can complicate recovery and create uncertainty around coverage. This is particularly relevant for businesses relying on public liability insurance to respond to third-party property damage at shared worksites.

How the Claim Was Handled in Practice

From a claims-handling perspective, the priority was to slow the situation down and reintroduce structure.

The insurer was asked to contact the third party directly to request additional time, easing the immediate pressure on the client. At the same time, all relevant documentation was gathered and submitted together to support the claim, including invoices for the damaged equipment, photos taken at the venue, and a clear incident summary outlining what occurred.

Submitting a complete evidence pack early allowed the insurer to assess the claim efficiently, without unnecessary delays.

Why No External Assessor Was Required

Not every claim requires an external assessor. In this case, the available evidence clearly established what caused the damage, the extent of that damage, and the value of the equipment involved.

Because liability and costs were straightforward, the insurer approved the claim based on the documentation alone. Removing the need for an external assessor shortened the timeline and avoided additional costs, allowing the claim to move through the system more quickly.

Why Online Claims Forms Fall Short in Situations Like This

Online claims forms play a role, but they have limits.

A form can record information, but it cannot:

- Communicate with a frustrated third party

- Request time to prevent escalation

- Influence how a claim is reviewed internally

- Advocate for unnecessary steps to be removed

In pressure-driven claims, outcomes often depend on communication, judgement, and coordination rather than automation alone.

What the Final Outcome Was

The claim was resolved in less than a month. The $10,000 was paid directly to the third party, avoiding double-handling and further dispute. The client’s insurance premium remained cost-effective, and the issue was settled with minimal disruption to business operations and production schedules.

What began as a high-stress situation was brought back under control before it escalated into a longer and more expensive dispute.

What Venue-Based Businesses Should Take From This

For businesses operating at venues or shared worksites, third-party damage claims are an ongoing risk. Pressure for immediate payment often arrives before insurers have had the chance to properly assess a claim, and how that pressure is handled can affect timelines, costs, and professional relationships.

Understanding how public liability insurance works in practice, and how claims are managed when third parties are involved, can reduce risk before an incident occurs.

If your business operates at live events, venues, or shared worksites, reviewing your public liability cover and understanding how claims are handled before an incident occurs can help prevent unnecessary pressure and delays. To discuss how this applies to your business, speak to one of the brokers at Tank Insurance.