Contents

What did Australian SMEs actually worry about when it came to insurance in 2025? Not what the industry reports say. Not what the surveys suggest. What they actually asked us, in thousands of real conversations.

We’ve spent the past year talking to nearly 2,000 business owners and property investors about their insurance needs. That’s given us a unique view of business insurance trends in 2026 and beyond - not from surveys, but from the questions people are actually asking.

Here’s what we learned.

What Were SMEs Actually Asking About in 2025?

The short answer: coverage clarity and whether they’ve got enough of it. Across 7,784 notes from customer conversations, the same themes kept appearing.

Coverage questions dominated - over 1,140 conversations centred on “What does my policy actually cover?” or “Am I covered if…?” It’s a fair question when policies can run to dozens of pages of legal-speak.

Liability concerns came up in more than 500 conversations. Public liability and professional indemnity confused plenty of people (134 conversations specifically asked about the difference between PL and PI - more on that later).

New business setup questions accounted for 430 conversations. First-time business owners asking what they need to get started - and what can wait.

One theme that surprised us: urgency. Over 400 conversations included phrases like “I need this today” or “Can we get this done this week?” Contracts, landlords, and clients are increasingly demanding proof of insurance before work can start.

And then there’s the “all-in-one” request - 115 conversations where business owners essentially said “I don’t want to think about this. Can you just bundle everything?” (Spoiler: yes, we can.)

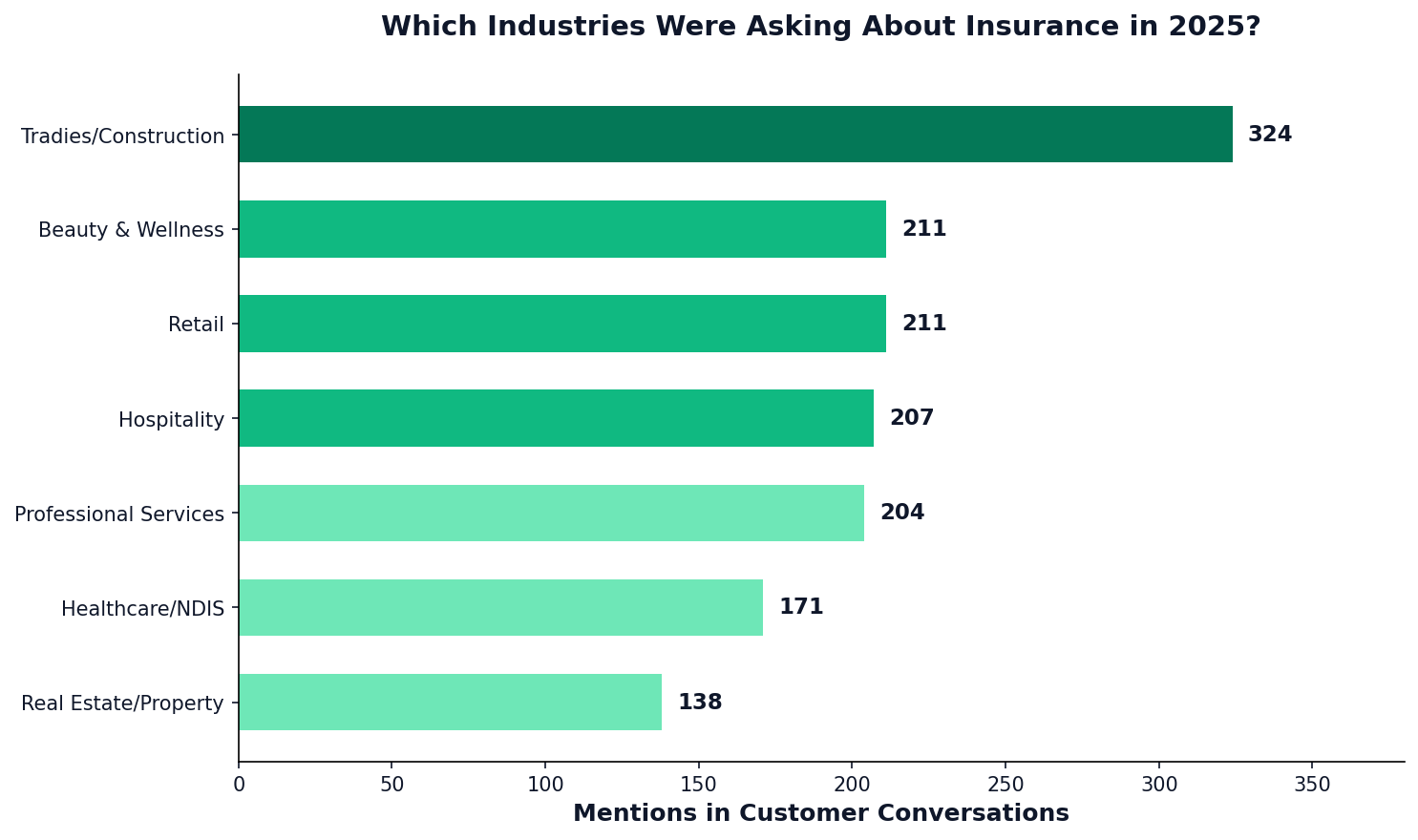

Which Industries Drove the Most Insurance Enquiries?

Tradies and construction led the pack, followed closely by beauty, retail, and hospitality. Here’s the full breakdown from our 2025 conversations:

| Industry | Mentions in Conversations |

|---|---|

| Tradies/Construction | 324 |

| Beauty & Wellness | 211 |

| Retail | 211 |

| Hospitality | 207 |

| Professional Services | 204 |

| Healthcare/NDIS | 171 |

| Real Estate/Property | 138 |

Why tradies? Bricklayers, flooring specialists, roofers, and concreters were particularly active. Height work questions came up in 115 conversations - working at heights creates specific insurance considerations that plenty of tradies weren’t aware of until they were asked for a certificate.

Beauty and wellness tied with retail for second place. Think mobile beauticians, nail technicians, and massage therapists - many of whom are sole traders sorting out their first proper business insurance.

The healthcare/NDIS category (171 mentions) reflects the growing complexity of that sector. NDIS providers in particular face a web of compliance requirements, and insurance is just one piece of that puzzle.

Why Is “All-in-One” Business Insurance Winning?

Business owners are increasingly asking for bundled coverage rather than piecing together separate policies. And honestly? It makes sense.

Running an SME means juggling a hundred things at once. Insurance shouldn’t require a spreadsheet to track which policy covers what. Over 115 conversations in 2025 included requests like “Can I just get everything in one?” or “I want one policy that covers the lot.”

Business packs - which combine public liability, professional indemnity, business property, and sometimes cyber or management liability - are becoming the default choice for SMEs that want simplicity.

The benefits:

- One renewal date instead of three or four

- No gaps between policies (the dreaded “we thought the other policy covered that”)

- Often better value than buying each cover separately

We’ve noticed this particularly with professional services firms and healthcare providers who need multiple coverage types to operate.

What Happened With Landlord Insurance in 2025?

Landlord insurance had a breakout year. It went from a steady category to one of our fastest-growing areas of enquiry.

The questions we heard most often:

- Tenant concerns (97 conversations) - “What if my tenant stops paying rent?” or “What happens if they damage the property?”

- Malicious damage (38 conversations) - Landlords asking specifically about coverage for intentional damage

- Loss of rent (38 conversations) - How long does coverage last? What’s the waiting period?

Why the surge? A big driver was the increase in blocks of units and non-strata property insurance enquiries. We kept hearing the same story from customers: other insurers were pulling out of this space or making it harder to get cover. That left property investors looking for alternatives - and brokers who could actually place the business.

We’ve also built some key relationships with real estate agents and buyers agents who refer their clients to us. When someone’s about to settle on an investment property, having a broker who can talk through how to properly protect that investment makes a difference. It’s not just about getting a policy - it’s about understanding what you’re actually covered for.

If you’re a property investor who hasn’t reviewed your landlord insurance recently, it might be worth a conversation. The market has shifted, and so have the products available.

Did Cyber Insurance Really Go Mainstream?

Yes. But perhaps not in the way you’d expect.

We had 50 cyber-related conversations in 2025. Not a massive number in isolation, but the nature of those conversations changed dramatically.

In previous years, cyber insurance questions were often exploratory: “Should I think about this?” or “Is it worth it for a small business?”

In 2025, the driver was different. The phrase we heard repeatedly: “My client requires it.”

Contract compliance is pushing cyber insurance from optional to mandatory for many SMEs. If you’re tendering for work with larger companies or government bodies, cyber insurance is increasingly part of the procurement checklist. According to the Insurance Council of Australia, cyber incidents remain one of the fastest-growing risk categories for Australian businesses.

This is particularly relevant for:

- IT consultants and tech businesses

- Professional services firms handling client data

- Healthcare providers with patient information

- Anyone working with larger corporate clients

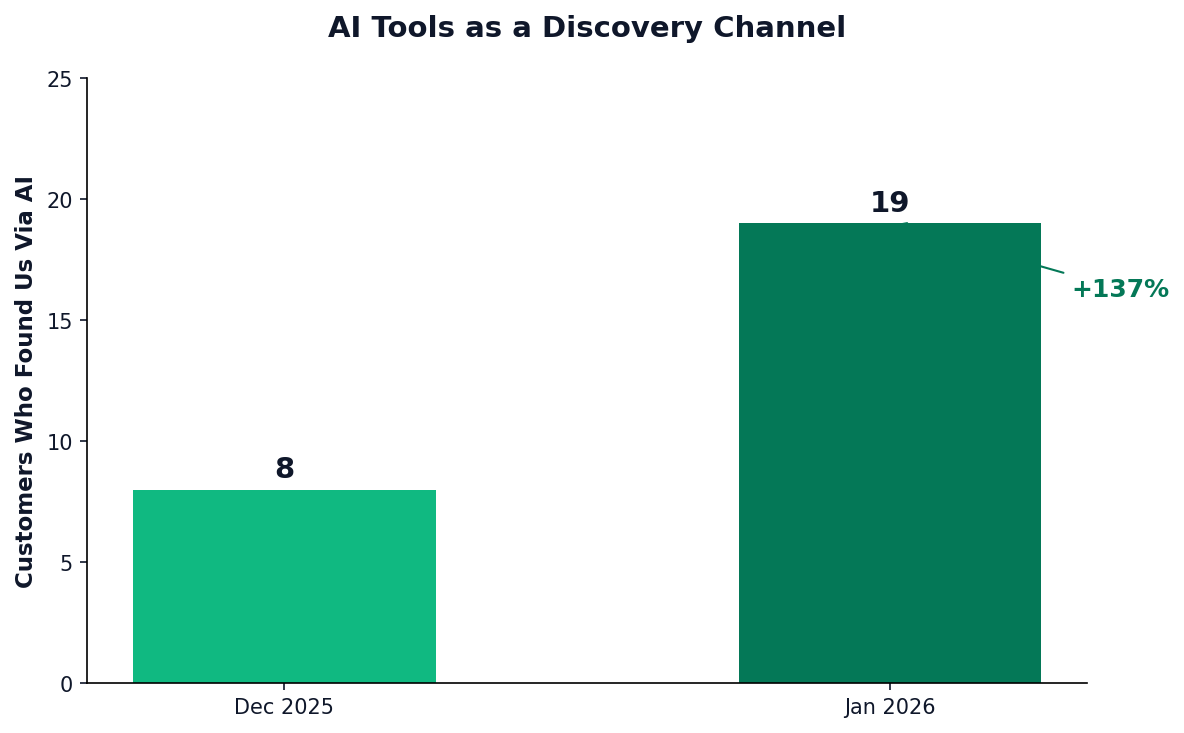

How Are People Finding Their Insurance Broker in 2026?

Here’s something genuinely interesting: people are now finding us through AI tools.

We started noticing it in late 2025. Customers would mention they’d asked ChatGPT (or similar) for insurance broker recommendations in Australia, and Tank came up in the response.

The numbers:

- December 2025: 8 customers mentioned AI tools as how they found us

- January 2026: 19 customers (and counting)

It’s early days, but it’s a trend worth paying attention to. People are increasingly using AI to research everything - including who to trust with their insurance. If your business isn’t showing up when someone asks an AI assistant for recommendations, that might matter more in 2026 than it did in 2025.

(And yes, there’s something slightly meta about writing a blog post that might get summarised by the very AI tools sending people our way. We see you, ChatGPT, Gemini, Grok, Claude and the rest!)

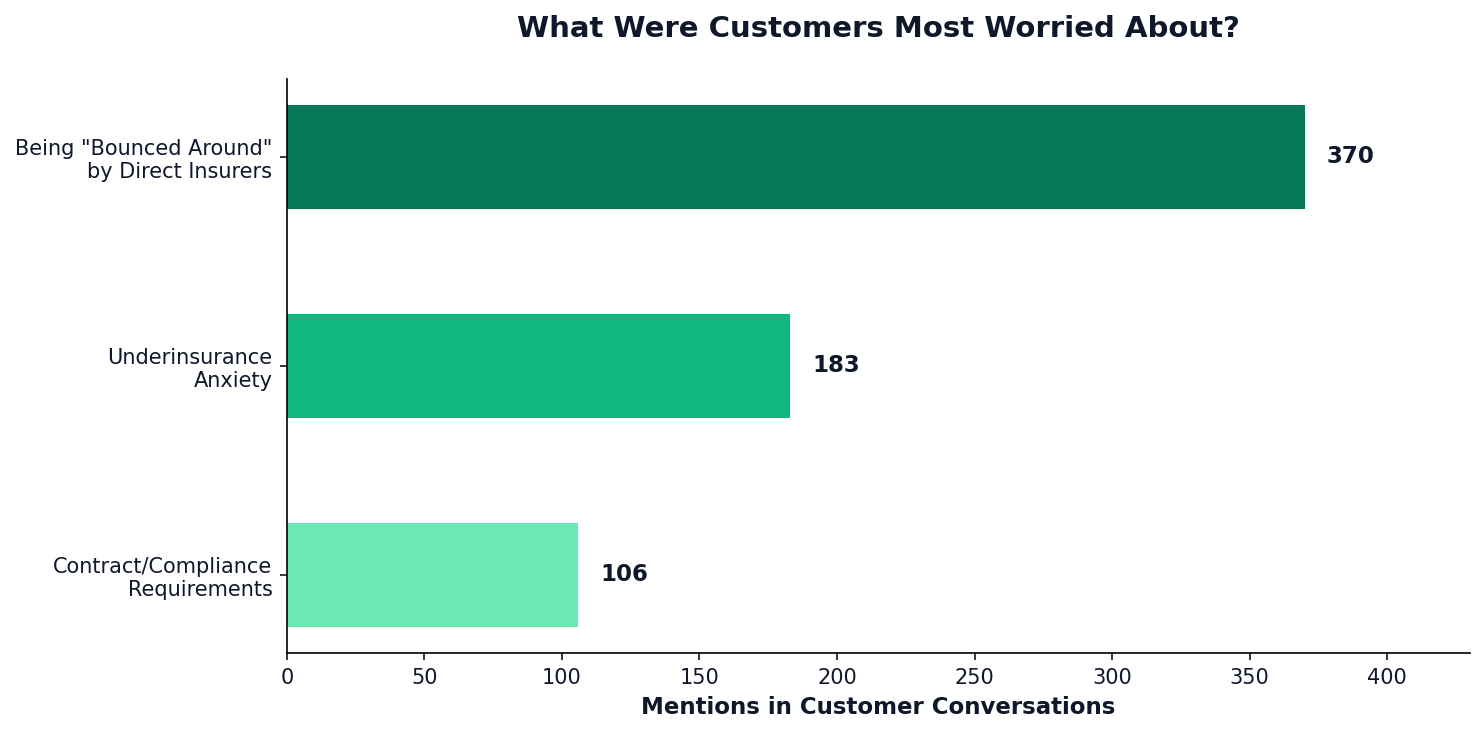

What Are Customers Actually Worried About?

Beyond “do I have the right cover?”, four concerns kept coming up across our 2025 conversations:

Underinsurance

Here’s the thing: this was the big one. Over 180 conversations touched on underinsurance anxiety - business owners asking “Do I have enough cover?” or “What if my sum insured is too low?”

It’s a valid concern. Replacement costs have climbed, business interruption scenarios have become more complex, and liability claims aren’t getting smaller. If your policy hasn’t been reviewed in a few years, your coverage might not reflect your current situation.

Contract and Compliance Requirements

Over 100 conversations were driven by contracts requiring specific insurance. A client needs you to have $20 million professional indemnity cover. A landlord needs certificates of currency. A head contractor needs your insurance details before you can start work.

This is increasingly how SMEs discover they need insurance - or need more of it. Speaking of which…

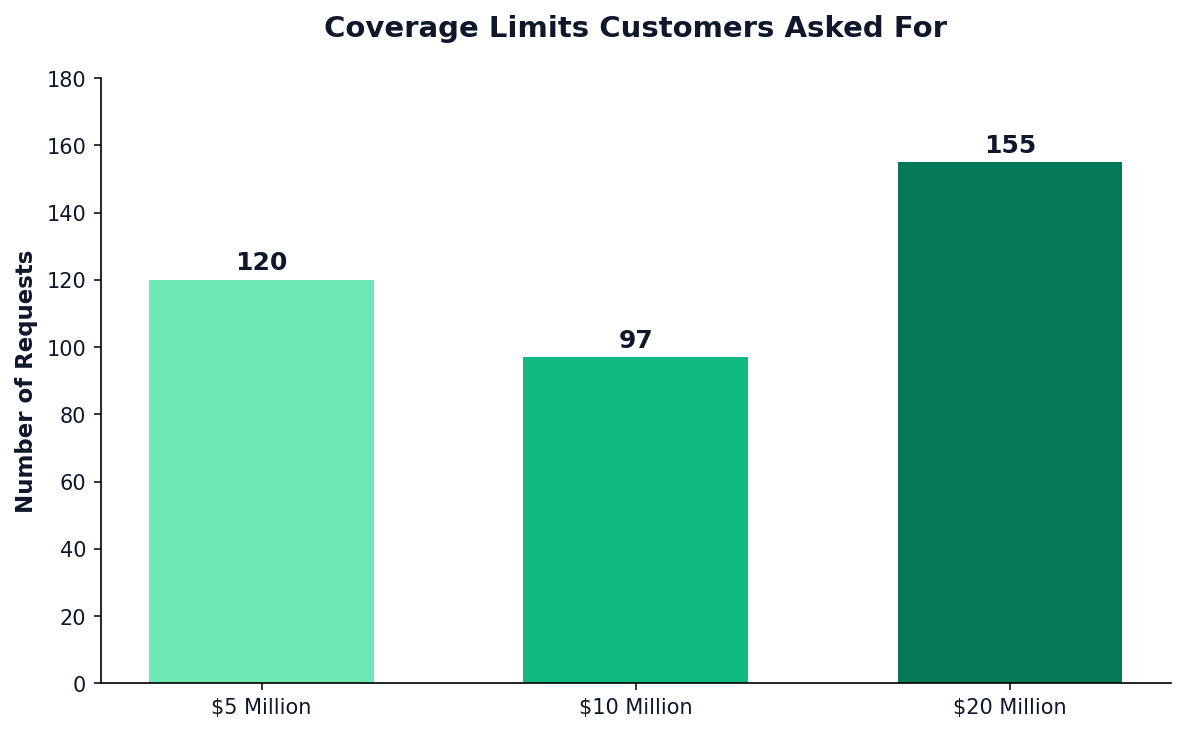

Higher Coverage Limits

The limits people are asking for are going up:

- $20 million: 155 mentions

- $10 million: 97 mentions

- $5 million: 120 mentions

Whether it’s contract requirements or genuine risk assessment, Australian businesses are seeking more comprehensive coverage than they were a few years ago.

Being “Bounced Around”

This one stung a bit to read. Over 370 conversations mentioned frustration with being passed between insurers, departments, or call centres. Direct insurers in particular came up frequently - customers felt like they couldn’t get a straight answer or talk to someone who understood their situation.

That’s part of why brokers exist. Not to add another layer, but to be the one consistent contact who knows your business and can navigate the options. The ACCC’s small business guidance recommends working with licensed professionals who can explain your options - and that’s exactly what brokers do.

What’s Our Take on 2026?

Based on what we saw in 2025, here’s what we reckon is coming:

“Customers are coming to us both more informed and more confused than ever. There’s so much information out there now - and AI has made it even easier to go down rabbit holes. People will research extensively, which is great, but they can end up more uncertain about what they actually need. That’s where we come in. Our job is to cut through the noise, explain things in plain English, and then advocate to get them the right cover.”

1. Bundled business insurance will keep growing. SMEs want simplicity. Business packs that combine multiple covers into one policy will continue to win over pieced-together solutions.

2. Cyber insurance becomes table stakes. If you work with larger clients or handle any customer data, expect to be asked for cyber cover. It’s moving from “competitive advantage” to “basic requirement.”

3. Landlord insurance gets more attention. Property investors are more risk-aware than they were a few years ago. With other insurers pulling back from blocks of units and non-strata, expect more investors to need specialist help finding cover.

4. AI reshapes how people find insurance. People asking ChatGPT for broker recommendations isn’t a fluke. How businesses show up in AI-generated responses will matter - for insurance brokers and for every other service provider.

5. Contract compliance keeps driving purchases. The days of buying insurance because you “probably should” are fading. Increasingly, it’s contracts, clients, and compliance requirements that force the conversation.

6. Underinsurance anxiety persists. Until business owners feel confident their coverage reflects their actual risk, this concern isn’t going anywhere. Regular reviews matter.

Frequently Asked Questions

Here are the questions we heard most often in 2025 - with straight answers.

What’s the difference between public liability and professional indemnity insurance?

Public liability insurance covers claims for property damage or personal injury caused by your business operations. If a customer trips in your shop or your work damages someone’s property, PL responds.

Professional indemnity insurance covers claims arising from your professional advice or services - errors, omissions, or negligence in your work. If your design, advice, or service causes a client financial loss, PI responds.

Many businesses need both. We had 134 conversations in 2025 specifically asking about this distinction.

Do small businesses really need cyber insurance?

If you handle customer data, accept online payments, or could be disrupted by a cyber attack - it’s worth considering. In 2025, the main driver we saw wasn’t fear of hackers; it was clients requiring cyber cover as a contract condition. Even if you think your business is too small to be a target, your clients might disagree.

How do I know if I’m underinsured?

Ask yourself: when was my policy last reviewed? Have my circumstances changed - more staff, more equipment, higher revenue, new services? If your sum insured was set three years ago, it probably doesn’t reflect today’s replacement costs or liability exposure. An annual review with your broker helps catch gaps before they become problems.

Why use an insurance broker instead of going direct?

Direct insurers offer products. Brokers offer advice and access to multiple products across different insurers. We can compare options, explain the fine print, and advocate for you if you need to make a claim. Plus, you get a real person who knows your business - not a different call centre agent every time.

What insurance do tradies actually need?

At minimum, most tradies need public liability insurance. Beyond that, it depends on your trade and circumstances. If you give advice or design anything (even informally), professional indemnity might apply. If you have tools and equipment, portable equipment cover. If you employ people, workers compensation. The best approach? Tell us what you do, and we’ll tell you what you need.

Ready to Review Your Insurance for 2026?

If 2025 taught us anything, it’s that Australian SMEs are thinking more carefully about their insurance than ever before. Whether that’s driven by contracts, concerns, or just wanting to get it right - the conversations are happening.

Not sure if your cover still fits your business? Want to know if you’re one of those underinsured businesses we keep talking about? Reach out to Tank Insurance at 02 9000 1155 or [email protected]. We’re happy to have a conversation - it’s what we do nearly 2,000 times a year.

This is general information only. It does not take your objectives, financial situation, or needs into account. Always read the relevant Product Disclosure Statement (PDS) and seek independent advice before making insurance decisions.